If a customer wishes to set up autopay, it is essential to understand the benefits, risks, and implementation process involved. This guide provides a comprehensive overview of autopay, empowering customers to make informed decisions and businesses to effectively implement this convenient payment option.

Autopay offers numerous advantages for both customers and businesses. Customers can enjoy the convenience of automated payments, eliminating the hassle of manual bill payments and reducing the risk of late fees. Businesses benefit from increased efficiency, reduced administrative costs, and improved cash flow predictability.

Customer Profile: If A Customer Wishes To Set Up Autopay

Customers who are more likely to set up autopay tend to be:

- Young and tech-savvy

- Have a stable income and good credit

- Use online banking and mobile payment apps

- Value convenience and time-saving solutions

Benefits of Autopay

For Customers:

- Convenience: No need to remember to make payments on time

- Time-saving: Automated payments save time and effort

- Reduced late fees: Avoid penalties for missed payments

- Improved credit score: Consistent on-time payments can boost credit scores

For Businesses:, If a customer wishes to set up autopay

- Increased revenue: Reduced late payments and increased cash flow

- Improved customer satisfaction: Customers appreciate the convenience of autopay

- Reduced administrative costs: Automating payments saves time and resources

- Enhanced customer loyalty: Customers are more likely to stay with businesses that offer autopay

Risks of Autopay

- Unauthorized payments: Ensure strong security measures to prevent fraudulent transactions

- Overdraft fees: Monitor account balances to avoid insufficient funds

- Payment errors: Check payment details carefully before setting up autopay

- Difficulty canceling: Some autopay systems may make it challenging to cancel payments

Customer Education

Educate customers about autopay through:

- Website and online resources

- Email campaigns and newsletters

- In-person or virtual presentations

- Customer service representatives

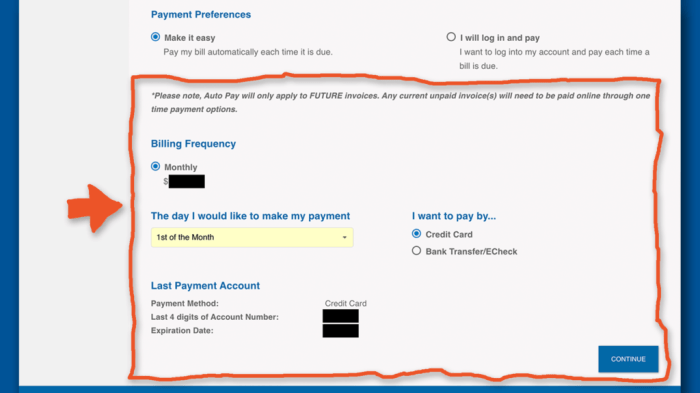

How to Sign Up, Cancel, and Manage Autopay:

- Provide clear instructions on how to set up, modify, or cancel autopay payments

- Explain how to manage payment details, update account information, and resolve any issues

Implementation Process

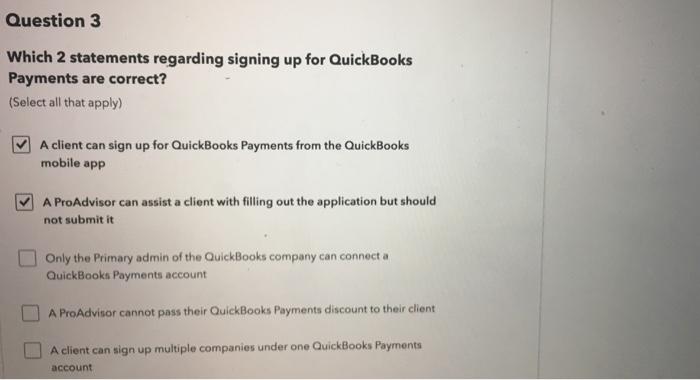

Technology Requirements:

- Payment gateway integration

- Secure data storage and encryption

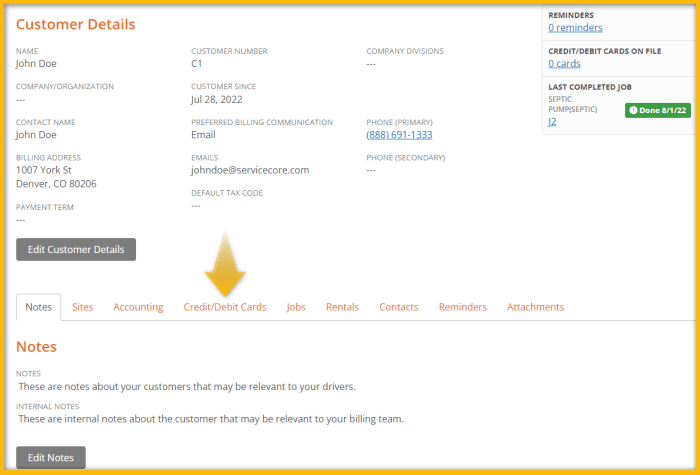

- Customer management system

Integration with Business Systems:

- Connect autopay system to accounting and billing systems

- Establish data transfer protocols and security measures

Customer Support

Provide comprehensive customer support for autopay:

- Handle inquiries and resolve disputes promptly

- Offer assistance with payment setup, cancellation, and management

- Educate customers about autopay benefits and risks

- Monitor customer feedback and make improvements as needed

Q&A

What are the benefits of autopay for customers?

Autopay offers convenience, reduces the risk of late fees, and can provide peace of mind by ensuring timely bill payments.

What are the risks associated with autopay?

Risks include unauthorized payments, overdraft fees, and potential errors in payment processing.

How can customers mitigate the risks of autopay?

Customers can mitigate risks by carefully reviewing payment details, setting up alerts for large transactions, and promptly reporting any unauthorized activity.

What steps should businesses take to implement autopay?

Businesses should provide clear communication about autopay, integrate with a secure payment platform, and establish a robust customer support system.